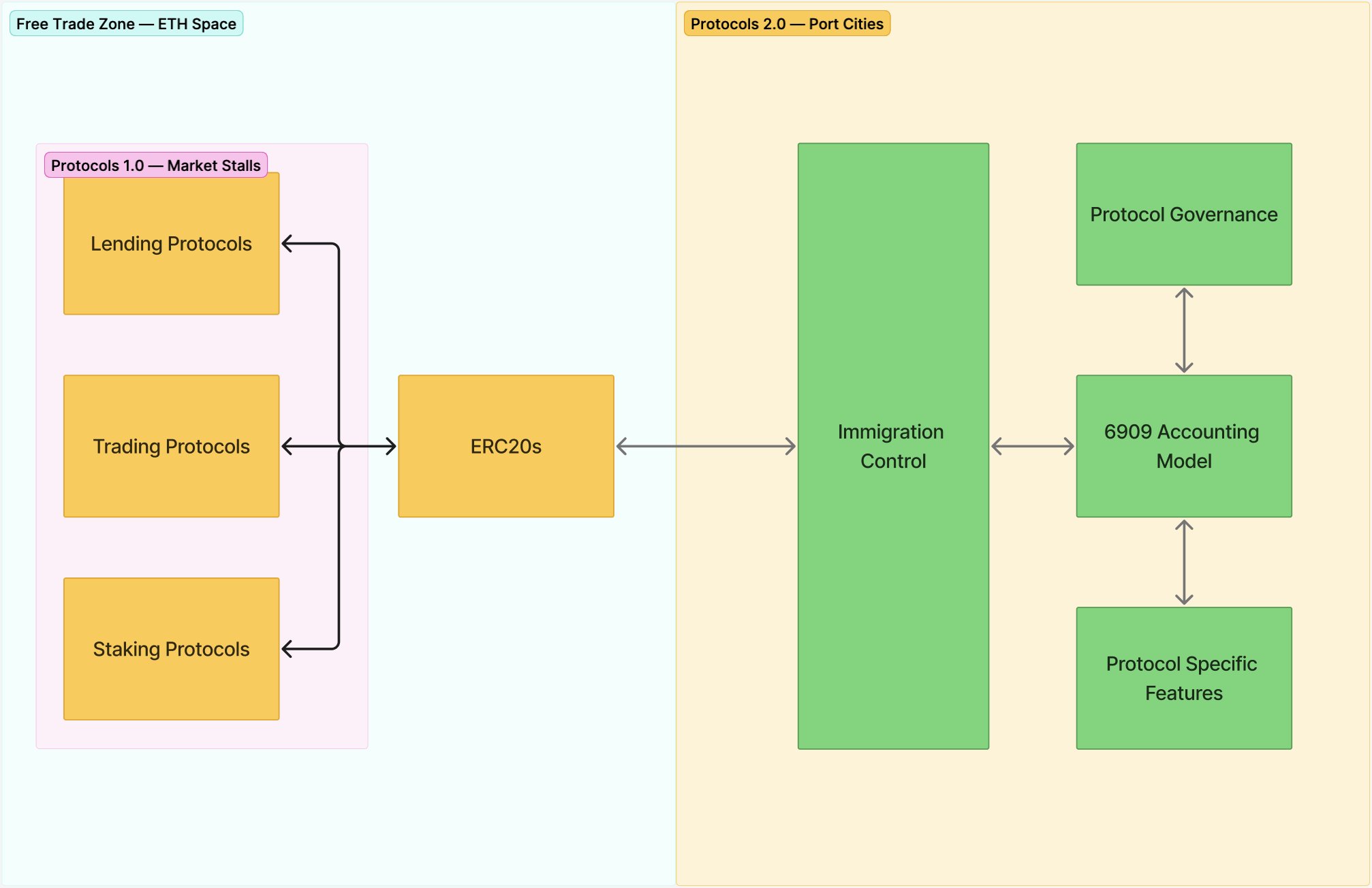

Ethereum protocols are evolving from market stalls to port cities.

Historically, Ethereum protocols have worked like simple market stalls. You bring your ERC-20 tokens, swap or lend them, and then move to the next stall. It's straightforward but limited.

EIP-7907 and ERC-6909 are changing this. With bigger contracts (EIP-7907) and efficient token management (ERC-6909), protocols will soon resemble historical port cities.

Port City Protocols offer:

Controlled borders: Protocols can set entry rules, charge fees, and verify the safety of incoming assets—similar to how port cities historically managed trade and tariffs.

Efficient asset management: Protocols use ERC-6909 to manage multiple assets within a single, organized ledger. This works like historical warehouse receipts, keeping assets safe and easily tradable. Since the entire protocol ruleset can exist within a single contract, there are minimal external calls and gas costs are drastically reduced.

Outside of Port City Protocols, assets remain easily tradable as standard ERC-20 tokens in market stall protocols (like Uniswap V3). Inside, each "city" provides specialized services and clear, structured management.

Port cities like Venice, Amsterdam, and Singapore emerged as trading hubs by clearly controlling their borders, efficiently managing goods, and providing structured, reliable governance. New Ethereum protocols, like Uniswap V4 and @z0r0zzz's ZAMM, are an idea of how protocols might adopt this strategy—providing users with structured security and management of assets.

When EIP-7907 is officially adopted, we'll likely see an explosion of Port City Protocols.