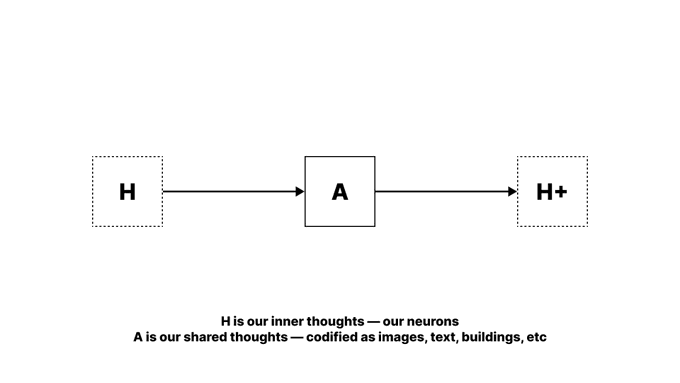

In 2015, economist Paul Romer introduced a simple model of knowledge growth called Human Capital and Knowledge. In short, he states that private thoughts in our minds (H) become public artifacts (A), like text, diagrams, or code. Others then use these artifacts to form new thoughts (H+). For example, a chef can share a recipe to teach others, or a videographer can create a movie to capture a story.

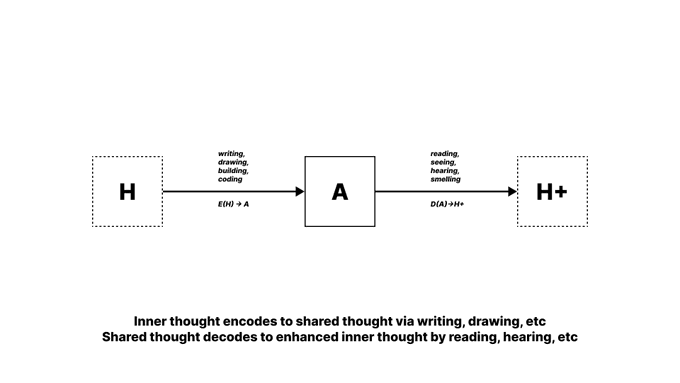

We can break down this model even further. To share ideas, we "encode" private thoughts into public content. To learn from public content, we must "decode" it back into new thoughts.

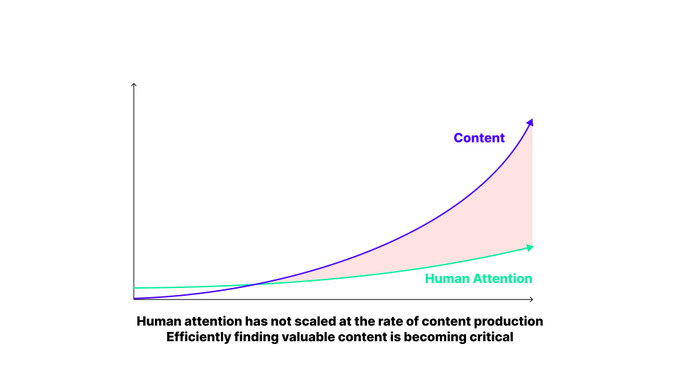

Historically, encoding ideas into shareable forms was costly — writing a book, producing music, or making a film took time and money. This limited the amount of content available. However, new creator tools augmented with AI have dramatically driven down the cost of creation. AI-driven tools now make creating high-quality content nearly instant and free. As a result, the amount of available content has exploded.

We now face a new dynamic. Creating content is easy, but finding valuable ideas in the sea of new content has become hard. Decoding — finding useful ideas — becomes critical. Efficient decoding creates a useful loop. When we can easily find valuable ideas, we can learn what content works best. This feedback loop makes content continuously better over time.

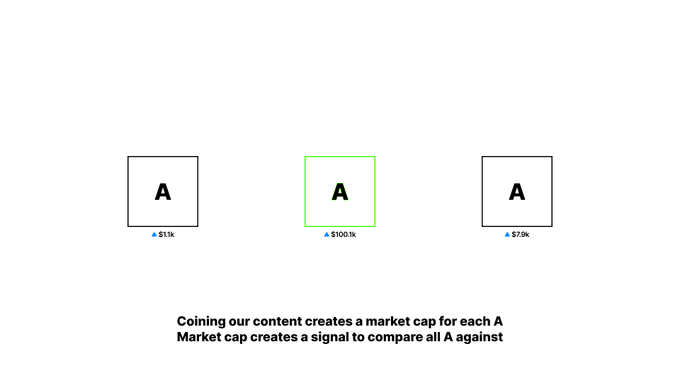

Market Cap as Signal

To find good ideas quickly, we need clear signals. Coins provide these signals. Coining creates an open market for content, and markets reflect what people collectively believe is valuable. High market values point us directly to the most useful ideas.

Open markets are better than closed systems like search engines or social media feeds. Closed systems hide how they choose content, favor quick attention, and distort value. Open markets are transparent. They gather perspectives from many people, continuously improving and clearly showing what content is genuinely valuable.

Initially, market values often reflect short-term popularity more than sustained value. However, since markets for coins are open and transparent, they naturally correct over time. Collective judgment continuously refines valuations, gradually filtering out fleeting popularity in favor of genuine, lasting insight.

Coins enable a collective valuation. By clearly showing value, they help us quickly find meaningful ideas and guide us toward better and more useful content.